Brakes

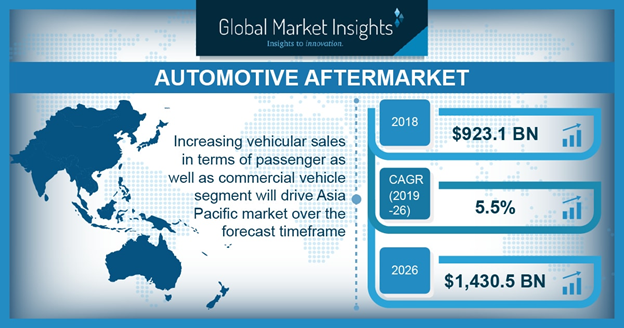

North America automotive aftermarket to accumulate substantial proceeds, global industry valuation to cross a humongous USD 1,420 billion by 2024

The changing preferences of consumers toward the comfort, appearance, & performance of vehicles has fueled automotive aftermarket to quite an admirable extent. As customers focus toward leading a luxurious lifestyle, complete with personalized vehicles for commuting in style, courtesy – increasing disposable incomes, automotive aftermarket is likely to witness lucrative gains in the years to come.

The subsequent wear and tear of existing automobiles will quite overtly lead to car owners wanting to replace old parts, enhance the vehicle’s appearance, and replace the car’s internal components for improved efficiency and safety. Eventually, this would propel the demand for state-of-the-art aftermarket parts, augmenting the commercialization landscape of automotive aftermarket.

U.S. Automotive Aftermarket, By Sales Outlet, 2017 & 2024, (USD Billion)

The ever expanding automotive sector is one of the most crucial drivers of the global automotive aftermarket. Over the last couple of decades, the demand for automobiles has only skyrocketed across the developed and developing economies. According to estimates by OICA, LCVs and passenger cars accounted for a sales figure of close to 86 million units in the year 2017 – apparently an upsurge of 2.4% when compared to the previous year. As the sales of commutable vehicles continue to increase and the demand for afterparts experiences an uptick, the remuneration portfolio of automotive aftermarket will undergo a significant change, as per experts.

Another trend that has lately made its presence felt in automotive aftermarket is the rising deployment of eco-friendly techniques in automotive manufacturing. Driven by a stringent regulatory landscape pertaining to environmental safety and the concerns stemming from rising carbon emissions, the demand for sustainable, alternative automobile parts has considerably increased, thereby driving the global automotive aftermarket share.

Unveiling North America automotive aftermarket trends over 2018-2024

North America, primarily driven by the United States and Canada, has been one of the most significant growth grounds for the global automotive aftermarket, which principally can be attributed to the expanding automotive industry in the region. The continent has been a witness to an upsurge in the production of new vehicles and the enhancement of older ones. Furthermore, the region is a powerhouse of technological advancements in automobile production and upgradation, which is likely to generate novel opportunities for aftermarket companies in the years to come.

North America is also remnant of a consumer base that demands increasing vehicle personalization, Bluetooth connection, digitization, and other interesting automotive electronics. The incorporation of advanced accessories is thus likely to drive North America automotive aftermarket. Incidentally, the region accounted for 30% of the overall automotive aftermarket share in the year 2017.

Get a Sample Copy of this Report @ https://www.gminsights.com/request-sample/detail/1166

Another pivotal factor likely to drive North America automotive aftermarket over the forecast period is the improved fuel economy that would quite overtly, augment the average miles that the customer drives, which would lead to increased wear and tear in vehicle parts. This would eventually fuel the requirement for aftermarket spare parts in the continent, stimulating North America automotive aftermarket industry trends.

Technological advancements have indeed had a major impact on the overall automotive aftermarket in the last half a decade. The surging demand for electrification and installation of software has been touted to generate novel avenues for aftermarket workshops and suppliers. The popularity of ADAS, infotainment systems, and telematics will also serve to augment the demand for technologically developed parts, that would help stimulate automotive aftermarket industry growth in the years to come.

Some of the most noteworthy players in automotive aftermarket fall along the likes of the 3M Company, Akebono Brake Corporation, Delphi, Denso, Continental AG, Robert Bosch GmbH, ACDelco, ASIMCO Technologies ltd., Federal-Mogul, Magneti Marelli, and more. In a bid to expand their reach across myriad geographies, these leading contenders have been rather proactive in adopting business growth tactics such as strategic collaborations. Citing an instance of the same, nearly a couple of years back, industry player Faurecia inked its third JV with its partners in Iran with an intention to consolidate its presence in the regional automotive aftermarket.

Author Name :Saipriya Iyer