Monoethylene Glycol industry report

Monoethylene glycol (MEG) market to register an exponential growth rate over 2017-2024, propelled by the high product demand from PET and polyester fiber applications

The extensive application spectrum of monoethylene glycol (MEG) market is one of the pivotal drivers responsible for its extensive growth in recent years. Subject to the fact that it is a basic raw material endowed with outstanding properties such as tenacity, durability, and hydrophobicity, it is used extensively to develop polyester fiber, that is further deployed in the manufacturing of ropes, outwears, garments, rugs, carpets, and numerous other household products. It is prudent to mention that global polyester fiber sector revenue stood at a massive USD 85 billion in 2016, and has been anticipated to expend further in the years to come, which will substantially augment the commercialization potential of monoethylene glycol industry as well. The utilization range of this material spans myriad niche verticals, pertaining to which MEG market size was pegged at an appreciable USD 25 billion in 2016.

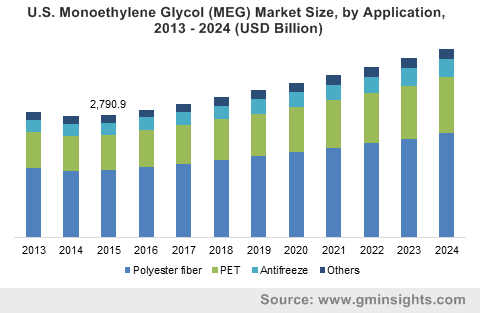

U.S. Monoethylene Glycol Market Size, by Application, 2013 – 2024 (USD Million)

Speaking along similar lines, it is imperative to elaborate on some of the vital pointers related to the expansion of MEG market via polyester fiber applications. As per statistics, 0.345 kg of MEG is used to produce 1 kg of polyester. The demand for new material in the fashion industry compounded with the polyester’s durable nature has led to polyester fiber gaining immense popularity in the last few years. Pertaining to its water-resistant quality and high tensile strength, the demand for polyester has considerably risen, which has indeed had a profound impact on MEG market outlook. As per estimates, polyester fiber accounted for 50% of the overall MEG market share in 2015.

With the growth of the packaged food and beverages domain, polyethylene terephthalate (PET) industry has witnessed an exponential growth in the recent years. The emerging economies characterized by rising population with growing population with increasing disposable incomes have been observed to lean toward using PET more extensively due to its low volatility and hygroscopic nature. As MEG is used in the production of PET, it would be arguably fair to state that MEG market size would be massively stimulated by the growing popularity of PET. In fact, as per Global Market Insights, Inc., PET is the fastest growing application segment of MEG market, and has been forecast to register a CAGR of 6.5% over 2017-2024.

Get a Sample Copy of this Report:@ https://www.gminsights.com/request-sample/detail/2198

MEG market has also been forecast will also receive major stimulus from the antifreeze and industrial grade usage of MEG. MEG is mainly used in manufacturing antifreeze for cars, aircrafts and other vehicles. Mixed with water, it is also used as a coolant and works below freezing temperatures. Unarguably, antifreeze and coolants are rather important in the automotive sector, as they keep liquids from freezing within engines and prevent major damage to the vehicle parts. Industrial grade MEG will also generate notable revenue for the MEG market in the forecast time span as MEG is extensively used in paints and coatings and cleaners for its high boiling point and solvent features.

Asia Pacific monoethylene glycol industry has been projected to register a rather commendable growth rate of 7% over 2017-2024, driven by the extensive contribution of countries such as India and China and the robust demand for polyester fiber in the region. The fact that more than 90% of the global polyester fiber production of 2014 took place in Asia Pacific affirms the aforementioned analysis. Subject to the robust economic growth of the emerging nations, higher disposable incomes and relaxed regulations on the manufacturing of MEG, Asia Pacific will register the highest demand as well as supply for MEG, providing a major stimulus to the regional MEG market. North America MEG industry on the other hand, may register a slower growth rate due to the imposition of stringent regulations on the manufacturing of MEG in these regions. In consequence, it has even been observed that major MEG industry players have shifted their base to Middle East and Africa.

The chief factor hindering the growth of the MEG market will be the product’s toxic nature. In the process of de-icing, MEG seeps into the soil and affect not only the underground water but also the health and well-being of humans and wildlife in the area. In response, many countries have banned the production of MEG, which has undoubtedly hampered the growth of monoethylene glycol industry. Apart from the regulatory pressure, fluctuating crude oil prices have also affected the growth of the MEG market, as the product is derived from ethylene – a downstream product of crude oil. However, these factors have not reduced the demand for PET or polyester and countries like India and China with relaxed governmental regulations on the use of MEG have helped the MEG market to grow considerably. As per estimates, MEG industry size has been projected to cross USD 40 billion by 2024, with a CAGR anticipation of 6% between 2017 and 2024.

Author Name : Paroma Bhattacharya