NBR Latex Market statistics

Nitrile Butadiene Rubber (NBR) Latex Market to accrue considerable proceeds via innovative product launches over 2018-2025, global industry landscape to be characterized by capacity expansion bids

Essentially driven by rising demand for synthetic rubber gloves in the medical and industrial sectors, the nitrile butadiene rubber (NBR) latex market has gradually emerged as one of the most enterprising verticals of polymers and advanced materials industry in the recent past. Prominent regulatory authorities such as OSHA have made it mandatory for industrial and manufacturing firms to provide high-quality safety equipment to employees working in hazardous conditions. Moreover, the synthetic rubber gloves are being increasingly recognized as a vital component in the overall medical devices and equipment across the healthcare sector which has invariably fueled the NBR latex industry trends.

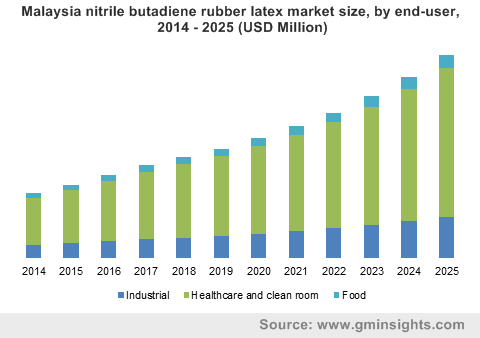

Malaysia nitrile butadiene rubber latex market size, by end-user, 2014 – 2025 (USD Million)

In order to enhance the overall manufacturing process and support faster product cycle rates, numerous major NBR latex market giants have increasingly focused on expanding production capacities at their existing facilities. For instance, the UK headquartered chemicals firm Synthomer PLC has recently announced to expand the manufacturing capacity of its Pasir Gudang plant. In this context, it would be prudent to mention that the demand for nitrile latex products from the healthcare and food sector has continued to increase rapidly in the recent past which has compelled the prominent NBR latex market player to undertake capacity expansion plans. Reportedly, the expansion would establish the Pasir Gudang plant as the largest nitrile polymerization reactor in the world with an annual capacity of nearly 100 kilo wet tons upon completion.

Get a Sample Copy of this Report:@ https://www.gminsights.com/request-sample/detail/2881

Elaborating further on the significance of the expansion plan, Synthomer would pour in an additional RM270 million at its innovation centers and NBR production facilities in Kluang and Pasir Gudang. Needless to mention, the installation of a new manufacturing line and additional investment bids would significantly strengthen the position of Synthomer PLC in the competitive landscape of the global NBR latex industry in the times to come. Moreover, such instances of massive capacity expansion efforts would undoubtedly assist companies to develop improved products aimed at meeting the evolving needs of customers from diverse business verticals, cite analysts.

One of the major factors to have significantly powered the NBR latex industry share augmentation is the ever-increasing demand for gloves from the medical sectors. In this regard, it is quite imperative to take note of the fact that glove manufacturers around the world have focused on producing high-performance and light-weight gloves while enhancing their process efficiencies at the same time. As glove manufacturing is the primary application of NBR latex industry, the latest advancements in NBR technology have proven to be rather beneficial for prominent glove producers in the recent times.

Citing an instance to highlight the technological enhancements being made, the Health and Protection unit of Synthomer launched a new grade of nitrile rubber in 2015 which helps in manufacturing ultrathin gloves that integrate maximum sensitivity with lower usage of raw materials. Apparently, the introduction of the new grade of nitrile rubber, named as Synthomer 6338, demonstrates the significance of consistent revamp of operational capability and innovative techniques being adopted by NBR latex market players.

Although the overall growth prospects of NBR latex market appear highly promising, it would be rather prudent to factor in the obstacles that might hamper product penetration in the years to come. As synthetic rubber is predominantly manufactured from petrochemical products, the constant fluctuations in crude oil prices might have an adverse impact on the budgetary provisions of companies operating in the NBR latex industry.

With a strict regulatory overview in place coupled with growing demand for synthetic rubber gloves in major industrial verticals such as mining, iron, steel, automotive, chemical, and metalworking, the NBR latex market share is forecast to expand at a decent pace in the years ahead. In fact, as per a research report collated by Global Market Insights, Inc., the commercialization portfolio of NBR latex industry is slated to surpass USD 2.4 billion by 2025.

Author Name :Saif Ali Bepari