Thermoplastic Elastomers Market analysis

U.S. Thermoplastic Elastomers Market (TPE) to register substantial gains over 2016-2023, high product demand from the automotive & medical sectors to fuel the regional growth

Increasing preference for low weight, sustainable, bio-based alternatives for conventional raw material will impel Thermoplastic Elastomers Market size. Subject to the efficient thermoplastic and elastomeric properties and myriad other physical and chemical benefits provided by these products, they are used extensively as alternatives for metals, regular & engineered plastics, wood, and natural or synthetic rubber across the automotive, medical, electronics, construction, footwear, and industrial sectors. Thermoplastic elastomers (TPE) industry was worth USD 12 billion in 2015, and is anticipated to hit a revenue of USD 20 billion by 2023, growing at a CAGR of 6% over 2016-2023.

In 2015, global thermoplastic elastomers market was consolidated, with major players accounting for more than 40% of the overall share. Companies such as Nippon Polyurethane Industry, BASF, China Petroleum & Chemicals, Kraton Polymers, Arkema S.A., Dow Chemicals, Covestro, LyondellBasell, and EMS Group are chief participants in thermoplastic elastomers industry. Firms have been focusing on investing in R&D and enhancing the product offering to sustain the market position. In addition, expansion of production capacity and mergers & acquisitions are among the key growth strategies adopted by these companies. For instance, Arkema had introduced Pebax Rnew into its elastomer family in 2014, which is a plastic derived from castor oil. Dupont has also introduced Hytrel RS, a highly renewable elastomer. Recently, BASF has heavily diversified its product portfolio by developing multiple versions of TPEs to partner with HP for launching its new 3D Open Materials and Applications Lab. Similar efforts by other companies will boost thermoplastic elastomers market outlook.

The high demand for inexpensive, reliable, sustainable, and light weight SUV and MUV models coupled with consumer preferences toward comfort and aesthetics will propel thermoplastic elastomers industry from automotive sector. In addition, strict government norms to reduce carbon emissions have forced automakers to use TPE products such as thermoplastic polyurethanes (TPU) as an alternative to metals, which will further impel thermoplastic elastomers market from automotive applications.

Get a Sample Copy of this Report @ https://www.gminsights.com/request-sample/detail/472

TPUs are heavily deployed for tubing applications in the automotive sector, subject to which thermoplastic polyurethanes (TPU) industry, having had a valuation of USD 1.5 billion in 2015, will witness a growth of more than 5% over 2016-2023. Additionally, this product is also used to construct cables and wires for the construction sector, subject to its properties of high thermal insulation and heat resistance, which will propel thermoplastic elastomers market from construction applications.

Thermoplastic vulcanizates (TPV) products are used in the automotive sector for fluid handlings, bumpers, and other applications. Its high heat and oil resistance properties have also lead to its usage for engine components and car interiors, thereby propelling TPV industry, set to grow at a CAGR of 5.5% over 2016-2023.

These products, subject to their superior thermal insulation and acoustic properties are also used in the construction sector. Pressure from regulatory bodies as regards to energy efficiency codes mandated for buildings will drive TPV market from construction applications. The rapid growth of the construction and automotive sectors globally will also aid the expansion of the product landscape of thermoplastic elastomers market.

Speaking of the expansion of the automotive and construction sectors, it would be prudent to mention the emerging economies of the APAC region. Asia Pacific thermoplastic elastomers industry, worth USD 4 billion 2015, will grow significantly over 2016-2023, subject to the vast number of automotive manufacturing units and the rising number of construction projects in the region. Subject to their superior properties, TPU and TPV products are heavily deployed across both these sectors, which will drive APAC TPE market over the next few years. India and China are touted to be the key contributors, with China having accounted for more than 60% of the APAC thermoplastic elastomers industry in 2015.

Since TPU products are heavily used in the automotive sector, China thermoplastic polyurethanes market size is expected to cross USD 500 million by 2023, growing at a CAGR of more than 6% over 2016-2023. Of late, OEMs across the world have shifted their manufacturing base to India and China, subject to the presence of a skilled labor workforce and an abundance of raw material availability. This is a key factor contributing to China TPU industry expansion.

Copolyester elastomers products are extremely resilient, versatile, and highly durable, subject to which they find huge applications across the electronics sector. Owing to their superior qualities, copolyester elastomers market will be worth more than USD 1 billion valuation by 2023.

Another key product of thermoplastic elastomers market, styrenic block copolymers, are known to possess excellent elastomeric properties along with high tensile strength, which will drive styrenic block copolymer (SBC) industry over the next few years. Hydrogenated SBC products offer even better properties, subject to which they are used mainly in CASE applications. These products are used in the medical, consumer goods, and packaging sectors, owing to which styrenic block copolymer market will earn a significant revenue over 2016-2023, having had a valuation of more than USD 6 billion in 2015.

The high demand for TPU, SBC, COPE, and TPV products across numerous application domains will consequently impel global thermoplastic elastomers industry size. These products are viable alternatives to thermosets, lids, gaskets, and medical stoppers, subject to which thermoplastic elastomers market from the medical sector will witness a significant growth.

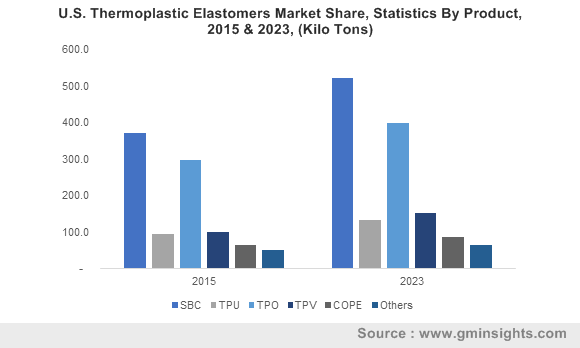

Geographically, North America contributed to more than 25% of the overall thermoplastic elastomers industry share in 2015. U.S. is a major revenue contributor, with a valuation of USD 1 billion in 2015. Subject to the growing usage of TPE products for medical equipment, sports equipment, and paving & roofing for construction, U.S. thermoplastic elastomers market will grow at a substantial rate over 2016-2023. In addition, increased EPA regulations to encourage the adoption of sustainable and bio-based products will stimulate the regional demand, thereby propelling North America thermoplastic elastomers industry.

TPE products have evolved as viable alternatives for ethylene propylene diene monomer (EPDM) and ethylene propylene rubber (EPR) in various industries, which will drive Europe thermoplastic elastomers market over the years to come. Subject to manufacturing low weight vehicles and achieving high fuel efficiency, Europe TPE market will witness significant gains over 2016-2023, with Germany, UK, and France being the key contributors.

Thermoplastic elastomer products are highly recyclable, and possess exceptional thermal insulation, molding, and heat resistance properties. They do not require compounding, and require no addition of stabilizers or reinforcing agents. Subject to these superior characteristics, these products find massive applications across numerous application sectors, thereby propelling global thermoplastic elastomers industry size.

Author Name :Saipriya Iyer