Residential Boiler Market Forecast

Europe Residential Boiler Market to witness commendable gains over 2017-2024, driven by a favorable framework promoting energy-efficient heating systems

Growing inclination toward energy-efficient heating systems across domestic arena is likely to bring a new dimension in residential boiler market trends. It has been observed that residential heating sector accounts for a major portion of GHG emission and carbon footprints at a global scale, a factor that has profoundly acted in favor of residential boiler market penetration across developing economies. This can be quite evidenced by the Environmental Protection Agency report in 2015, which claimed that U.S. commercial and residential sector together accounted for almost 12% of the overall GHG emissions in that particular year. In response to this environmental call, a plethora of codes and standards have been implemented worldwide toward sustainable heating technologies, which by extension has fueled residential boiler industry demand. As per a report put forward by Global Market Insights Inc., the overall industry is set to hit an annual installation capacity of 10 million units by 2024.

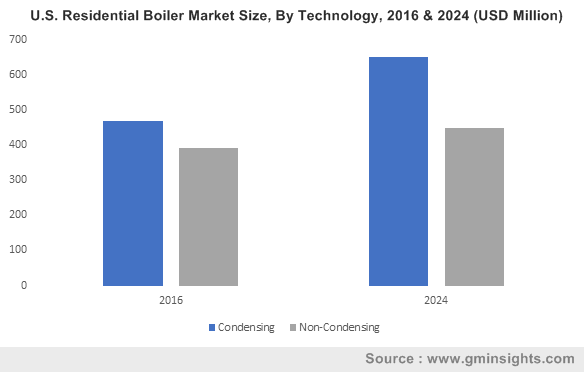

U.S. Residential Boiler Market Size, By Technology, 2016 & 2024 (USD Million)

A stringent regulatory landscape speaks volume and has contributed immensely in the remodeling of residential boiler market dynamics. Despite the fact that these regulations refer to U.S. alone, the impact of these standardization has been observed at a global scale. The U.S. ECPA (Energy Policy and Conservation) Act of 1975 imposed energy conservation standards on various consumer products including residential boiler. As per the amendment, the U.S. (DOE) Department of Energy periodically updates the energy efficiency standards and consumer guidelines pertaining to residential boilers. In fact, as per the recent norms, all gas fired hot water boilers that are manufactured between the period 1st Sept 2012 to 15th January 2021 must have a minimum AFUE (Annual Fuel Utilization Efficiency) of 84%. Speaking along the similar lines, natural gas fueled residential boilers accounted for 50% of the overall residential boiler industry share in 2016.

Get a Sample Copy of this Report@ https://www.gminsights.com/request-sample/detail/2034

Ongoing investments toward residential construction along with increasing demand for energy efficient space heating system across major economies have proliferated residential boiler market outlook. In 2016, China invested around USD 1 trillion in the residential building sector. In addition to this, the Chinese government’s increasing initiative toward establishing zero emission buildings will finally lead to a replacement of traditional heating systems with efficient residential boilers, which in no surprise will impact the regional residential boiler market size.

Taking into account the European government’s favorable energy efficient retrofitting policies toward refurbishment of traditional heating units, it is certain that Europe will also turn out to be a strong contender in the global residential boiler industry over the coming years. Under the scheme, landlords are provided 10% grant for deploying oil and gas fired condensing boilers in their residential complex. In the year 2015, renovation, maintenance, and refurbishment activities almost accounted for 60% of the overall residential spending across European belt, another statistic that is shedding a positive light on the regional residential boiler market outlook. With Germany covering 14% of the regional share in 2016, Europe residential boiler market is expected to witness substantial growth in the coming seven years.

As per a report compiled by Global Market Insights, Inc., the overall residential boiler market will exceed USD 12 billion by the end of 2024. Continuous product innovations by the leading giants along with a strong regulatory groundwork are sure to bring a renewed dimension in the residential boiler industry outlook. In addition, increasing number of government initiations toward sustainability trends and expansion in the residential construction sector is certain to contribute toward the overall business growth. Some of the prominent participants involved in this space include AC Boilers, Lennox, NTI Boilers, Bosch, Weil-McLain, HTP, Viessmann, and Parker Boiler.

Author Name : Satarupa De